Strike Price vs Market Price: Key Differences Explained

Introduction

In options trading, the terms strike price and market price often come up together—but they’re not the same. Confusing the two can lead to poor trading decisions. In this guide, we’ll break down the differences between these two essential prices and how each plays a role in your options strategy.

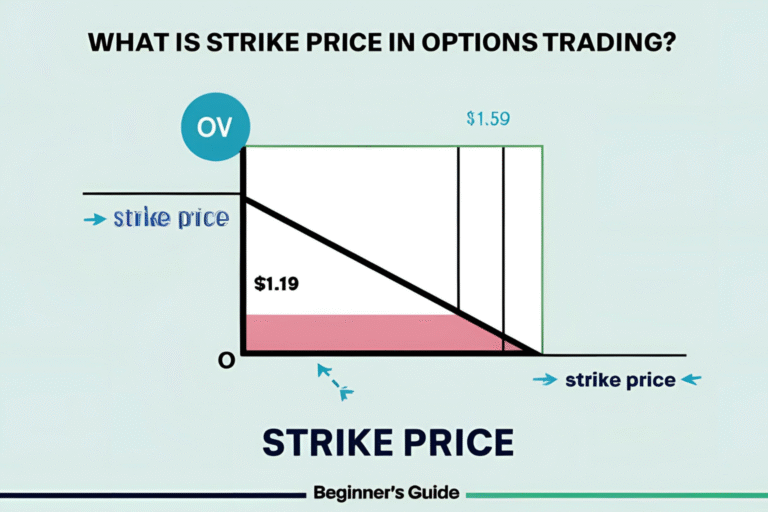

What Is a Strike Price?

The strike price is the pre-agreed price at which the buyer of an option can buy (call) or sell (put) the underlying asset. It’s fixed and chosen when the option is created.

For example, if you buy a call option on NVIDIA with a strike price of $900, you have the right to buy it at $900—even if it trades higher.

What Is a Market Price?

The market price is the current price at which the underlying asset is being traded in the open market. This price fluctuates constantly based on supply and demand.

Continuing the example: If NVIDIA’s stock is now trading at $920, the market price is $920.

Key Differences Between Strike Price and Market Price

| Feature | Strike Price | Market Price |

|---|---|---|

| Definition | Fixed price in option contract | Real-time trading price |

| Changes Over Time | No | Yes, changes every second |

| Set By | Options exchange | Open market |

| Role in Trading | Determines exercise value | Used to evaluate contract worth |

Why These Differences Matter

The difference between strike price and market price determines whether the option is:

- In-the-money (ITM): Profitable to exercise

- At-the-money (ATM): Market price ≈ strike price

- Out-of-the-money (OTM): Not profitable to exercise

This impacts the premium you pay and the potential returns you can make.

Example: Call Option

You buy a call option for Tesla:

- Strike Price: $800

- Market Price: $850

You can buy Tesla shares for $800 when the market is offering them at $850. The option is $50 in-the-money.

Example: Put Option

You buy a put option on Microsoft:

- Strike Price: $300

- Market Price: $280

You can sell Microsoft at $300 even though it’s only worth $280 in the market.

Conclusion

Understanding the strike price vs market price distinction is critical for analyzing your option’s profitability. The relationship between the two prices directly affects whether your trade makes money or not.

FAQs

Q1. Can strike price and market price be the same?

Yes. This is called “at-the-money” and usually means the option has little or no intrinsic value.

Q2. Which is more important: strike price or market price?

Both are crucial. The strike price defines the contract; the market price determines its value at any moment.

Q3. Do strike prices change?

No. Once set in a contract, the strike price is fixed.

Q4. Is the market price what I pay for the option?

No. You pay the option premium, which is influenced by both strike and market prices.

Q5. How do I profit from the difference?

Buy options when you believe the market price will move favorably beyond the strike price, factoring in the premium paid.