How to Set Strike Prices for Intraday Options Trades

Introduction

Intraday options trading is fast-paced and requires precision—especially when it comes to choosing the right strike price. The wrong strike can lead to missed profits or complete losses due to time decay. In this guide, we’ll help you understand how to set strike prices for intraday trades based on delta, volatility, and market momentum.

What Makes Intraday Options Trading Different?

- Short holding periods (minutes to hours)

- Time decay (theta) is faster and more damaging

- High reliance on technical levels and momentum

- Strike price selection must align with speed of movement

1. Use ATM or Slightly OTM Strike Prices

In intraday trading, price must move quickly. That’s why at-the-money (ATM) or slightly out-of-the-money (OTM) strike prices are the best fit.

Why?

- Faster premium response to price movement

- Better liquidity and tighter bid-ask spreads

- Reduced slippage for fast entries and exits

2. Choose a Delta Between 0.30 and 0.50

Strike prices with delta between 0.30 and 0.50 offer a good balance of price sensitivity and cost.

- ATM = ~0.50 delta

- Slight OTM = ~0.30 delta

- Avoid deep OTM (delta < 0.15)—they move slowly and often expire worthless

3. Consider Implied Volatility (IV)

- High IV = higher premiums and faster option movement

- Avoid overpriced strikes during earnings or major events unless volatility is your edge

Tip: Use IV Rank to know if IV is relatively high or low for the underlying.

4. Match Strike Price with Key Technical Levels

Set your strike price near:

- Support/resistance zones

- VWAP

- Moving averages (e.g., 20 EMA, 50 SMA)

- Opening range breakouts

Example:

If SPY is trading at $510 and breaking a resistance at $512, consider a $512 or $515 strike call.

5. Focus on Weekly Expirations or 0DTE

- Use 0DTE (zero days to expiration) options only if you’re experienced

- 1–3 DTE options allow slightly more time, reducing theta risk

Example Trade Setup (TSLA at $800)

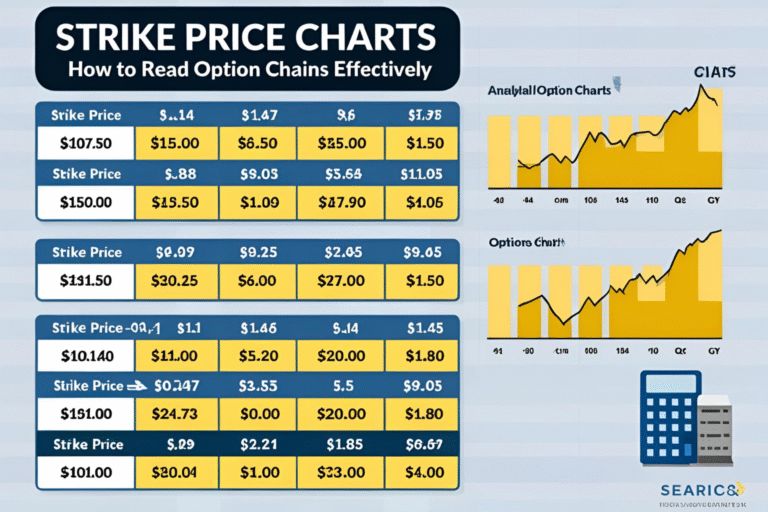

| Strategy | Strike Price | Delta | Use Case |

|---|---|---|---|

| Quick breakout trade | $800 (ATM) | 0.50 | Momentum entry |

| Lower cost entry | $805 (OTM) | 0.30 | Strong move expected |

| Conservative hedge | $790 (ITM) | 0.65 | Lower risk, higher cost |

Tips for Success

- Exit quickly—don’t wait for full profit potential

- Avoid holding through lunch hours (low volume, high risk)

- Always use stop-loss levels and monitor option price decay

- Never overleverage with deep OTM strikes

Conclusion

Setting the right strike price for intraday options is all about balance: delta, cost, and momentum. Stick with ATM or slightly OTM, watch the technical levels, and prioritize liquidity for clean execution. Precision here can turn short trades into consistent profits.

FAQs

Q1. Should I use deep OTM options for intraday trades?

No, they rarely move fast enough and are too risky for short timeframes.

Q2. Can I use weekly options for intraday?

Yes, weekly options are great for intraday due to tighter strike spacing and high volume.

Q3. What’s the best delta for intraday options?

Between 0.30 and 0.50 is ideal—good price movement with manageable cost.

Q4. How many strikes OTM should I go?

1–2 strikes OTM is usually safe. Further out increases risk.

Q5. Are 0DTE options good for beginners?

No. They move extremely fast. Beginners should use options with 2–5 DTE instead.