Strike Price Glossary: All Terms You Must Know as an Options Trader

Introduction

New to options trading? Understanding the strike price is just the beginning. This glossary will help you decode the most important strike price-related terms, making it easier to read option chains, plan trades, and manage risk like a pro.

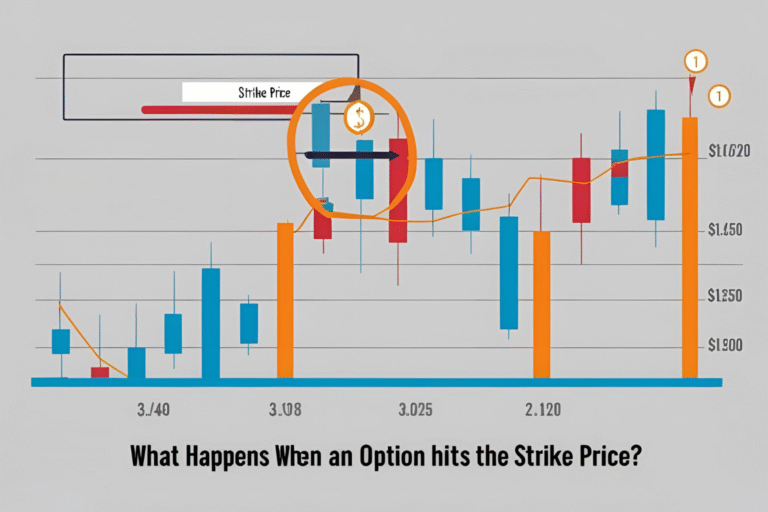

🔹 Strike Price

The fixed price at which the buyer of an option can buy (call) or sell (put) the underlying asset.

🔹 Moneyness

Describes the relationship between the strike price and the market price of the underlying asset.

- In-the-Money (ITM): Option has intrinsic value

- At-the-Money (ATM): Market price ≈ Strike price

- Out-of-the-Money (OTM): Option has no intrinsic value

🔹 Premium

The price paid by the buyer to the seller for the option. It consists of:

- Intrinsic Value (if any)

- Time Value (based on time remaining and volatility)

🔹 Intrinsic Value

The actual value of an option if exercised now.

- Call: Market Price – Strike Price (if > 0)

- Put: Strike Price – Market Price (if > 0)

🔹 Time Value

The extra premium paid for the time remaining until expiration. It erodes as the option nears expiry (also called theta decay).

🔹 Delta

Measures how much an option’s premium is expected to move with a $1 change in the underlying asset.

- ATM delta ≈ 0.50

- ITM delta > 0.50, OTM delta < 0.50

🔹 Open Interest (OI)

The number of active contracts for a specific strike price and expiration. High OI = better liquidity.

🔹 Bid-Ask Spread

The difference between the price buyers are willing to pay (bid) and the price sellers are asking (ask). Narrow spreads = better execution.

🔹 Break-Even Price

The price the underlying asset must reach for the option buyer to avoid a loss.

- Call: Strike + Premium

- Put: Strike – Premium

🔹 Assignment

Occurs when the option seller is obligated to fulfill the contract—buy or sell shares at the strike price.

- Usually happens at expiration for ITM options

🔹 Exercise

When the option buyer chooses to buy (call) or sell (put) the underlying asset at the strike price.

🔹 Expiration Date

The last day the option is valid. After this, it becomes worthless if not exercised or closed.

Quick Reference Table

| Term | Meaning |

|---|---|

| Strike Price | Agreed price to buy/sell the asset |

| Moneyness | ITM, ATM, or OTM status |

| Premium | Option cost (Intrinsic + Time value) |

| Delta | Sensitivity of premium to stock price |

| Break-even | Price where trade becomes profitable |

| Expiration | Date the option contract expires |

| Assignment | Seller’s obligation if buyer exercises |

Conclusion

This strike price glossary gives you the foundation to understand and evaluate any options contract more effectively. Bookmark this list for quick reference as you grow your trading knowledge.

FAQs

Q1. What’s the most important term to understand first?

Start with moneyness—it determines whether your strike price is profitable.

Q2. What’s the difference between strike price and premium?

Strike price is the exercise price; premium is the cost to buy the option.

Q3. Is delta important when selecting strike price?

Yes. It helps estimate how much your option might move per $1 change in the stock.

Q4. What’s a good delta for beginners?

A delta between 0.30 and 0.50 gives a balance of affordability and movement.

Q5. Where can I see all this info in real time?

Most trading platforms show it in the option chain—including strike prices, deltas, IV, and more.