How to Pick Strike Prices for Weekly Options: A Step-by-Step Guide

Introduction

Weekly options offer flexibility and fast trading opportunities—but success starts with picking the right strike price. Weekly expirations come with limited time, higher time decay, and often quick market reactions. In this guide, you’ll learn how to pick strike prices for weekly options based on your risk level and market outlook.

What Are Weekly Options?

Weekly options are contracts that expire every Friday, offering traders short-term exposure to market moves. They’re popular for:

- Day traders and swing traders

- News/event-driven strategies

- High-frequency income generation

Why Strike Price Matters More in Weeklies

Because the time until expiration is so short (often 1–5 days), the strike price selection is critical to balance between:

- Cost (premium)

- Probability of success

- Profit potential

Step-by-Step: How to Pick the Right Strike Price

1. Check Current Price and Market Direction

- If you’re bullish: focus on ATM or slightly OTM calls

- If you’re bearish: use ATM or slightly OTM puts

2. Use Delta to Filter Strike Prices

- Delta 0.30–0.50 for a good risk-reward balance

- Lower delta (0.20) = cheaper, riskier

- Higher delta (0.60+) = more expensive, safer

3. Review Implied Volatility (IV)

- High IV inflates premiums—choose strikes carefully to avoid overpaying

- During earnings or news events, go more conservative with strike selection

4. Pick Expiry Day Relative to Entry

- If buying Monday, choose Friday expiry (5DTE)

- If trading on Thursday, go for next week’s expiry if unsure of direction

5. Use Support & Resistance for Strike Anchors

- Identify key chart levels and choose strikes near those levels for precision

Example: Weekly Trade on SPY (Trading at $510 on Monday)

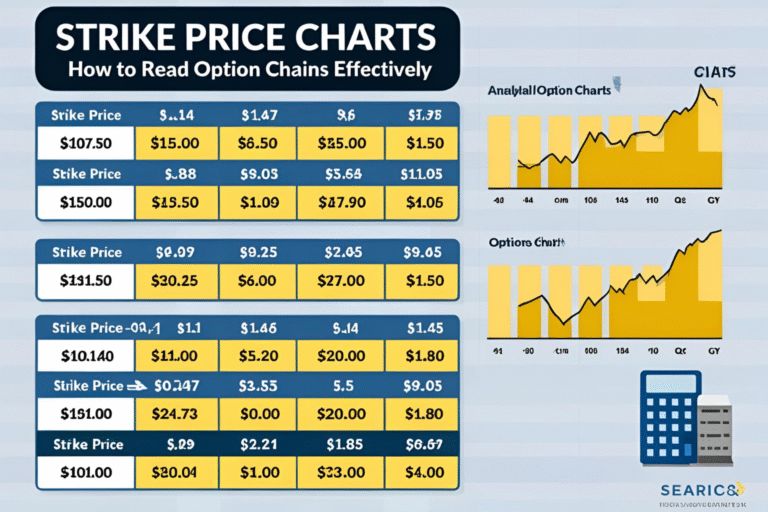

| Strike Price | Option Type | Premium | Delta | Suitable For |

|---|---|---|---|---|

| $510 | Call (ATM) | $3.20 | 0.50 | Directional day/swing trade |

| $515 | Call (OTM) | $1.20 | 0.30 | Speculative pop trade |

| $505 | Call (ITM) | $5.80 | 0.65 | Conservative setup |

Tips for Weekly Strike Price Trading

- Avoid deep OTM—they often expire worthless

- Use spreads to reduce risk and cost

- Focus on liquid options with tight bid-ask spreads

- Monitor price action closely—weeklies move fast

Conclusion

Weekly options give traders high flexibility but require precision in strike price selection. Stick with ATM or slightly OTM/ITM depending on your goal, manage risk with delta, and always consider time decay. Choosing the right strike can be the difference between profit and total loss.

FAQs

Q1. Are weekly options riskier than monthly options?

Yes, due to faster time decay and shorter trade windows.

Q2. What’s the best strike price for weekly income?

ATM or slightly OTM, combined with high-volume tickers like SPY or QQQ.

Q3. Can I hold weekly options overnight?

Yes, but price movement must happen quickly before expiration.

Q4. Should I avoid weekly options with earnings nearby?

Only trade them if you understand volatility risk and have a defined plan.

Q5. What’s the cheapest strike price to pick?

Cheapest is often deep OTM—but these rarely succeed. Stick with ATM/near-ATM for better odds.