How to Choose the Right Strike Price for Call Options

Introduction

Selecting the right strike price for a call option can make or break your trade. Whether you’re aiming for conservative gains or taking on more risk for higher rewards, the strike price plays a crucial role in shaping your outcome. This guide will walk you through the key factors to consider when choosing a strike price for call options.

What Is a Call Option Strike Price?

The strike price is the price at which you have the right to buy the underlying asset. In call options, a lower strike price usually means a more expensive premium but a higher probability of profit.

Three Common Strike Price Choices for Call Options

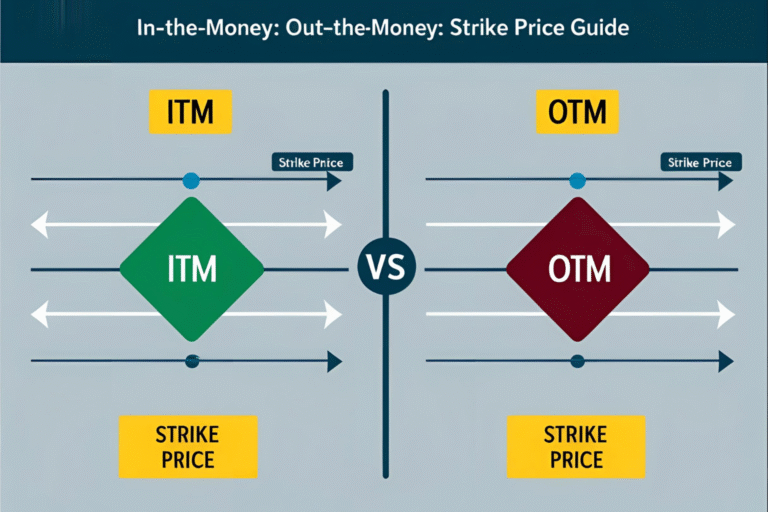

- In-the-Money (ITM)

- Strike price is below the current market price

- Higher cost, higher probability of profit

- Best for conservative or directional trades

- At-the-Money (ATM)

- Strike price is equal to current market price

- Balanced risk and reward

- Common for near-term trades or quick moves

- Out-of-the-Money (OTM)

- Strike price is above current market price

- Lower cost, higher risk

- Suitable for high-risk, high-reward setups

Key Factors to Consider

1. Your Market Outlook

- Bullish but cautious? Go ITM.

- Expecting a strong move? Try OTM.

- Expecting moderate gains? Choose ATM.

2. Time to Expiry

- Short-term options often do better with ITM or ATM.

- Long-term options (LEAPS) allow more flexibility for OTM positions.

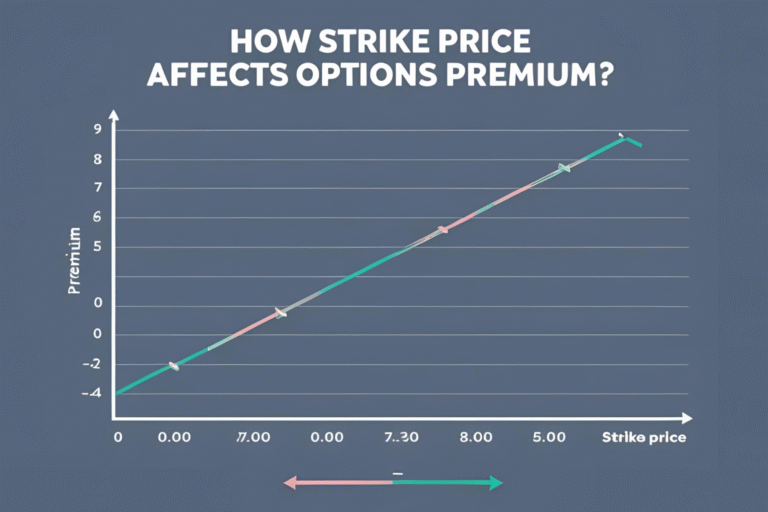

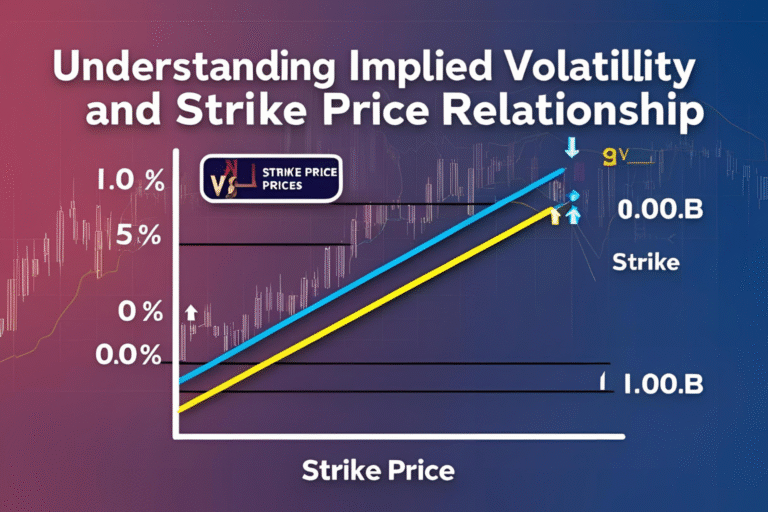

3. Volatility Conditions

- High implied volatility increases option premiums.

- In volatile markets, closer-to-the-money strikes are safer.

4. Risk Tolerance

- ITM: Safer, more capital required.

- OTM: Cheaper, riskier, needs strong price move.

- ATM: Balanced, good for neutral to moderately bullish setups.

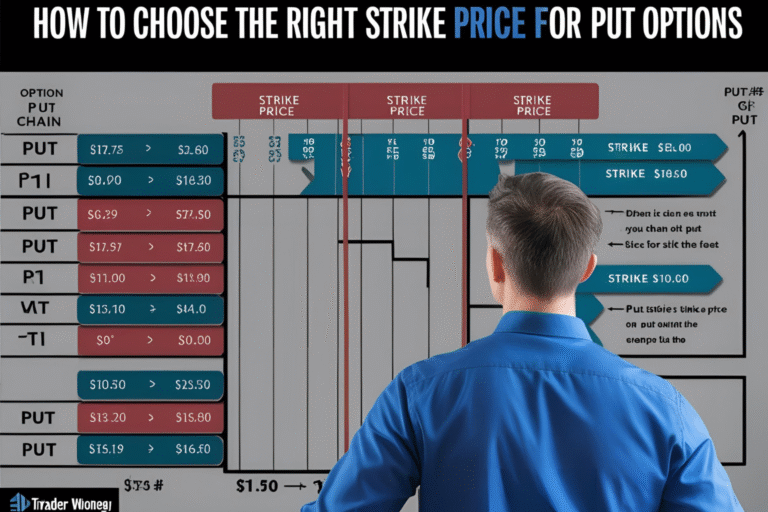

Real Example

Let’s say Amazon (AMZN) is trading at $140:

| Strike Price | Option Type | Premium (Example) | Risk Level | Reward Potential |

|---|---|---|---|---|

| $130 | ITM | $15 | Low | Moderate |

| $140 | ATM | $9 | Medium | Good |

| $150 | OTM | $4 | High | High |

Best Practices

- Start with ATM or slightly ITM for higher win rates.

- Use OTM when aiming for a specific price target and low capital risk.

- Always compare break-even points (strike price + premium).

FAQs

Q1. What’s the safest strike price for a call option?

In-the-money strikes are generally safer but cost more.

Q2. Should I always buy ATM call options?

ATM is common for balanced setups, but your decision should depend on outlook and risk.

Q3. Can I change my strike price later?

No, once you buy an option, the strike price is fixed.

Q4. What if my call option is out-of-the-money at expiry?

It expires worthless, and you lose the premium paid.

Q5. How do I find the best strike prices on a platform?

Use the options chain. Look for open interest, delta values, and premium costs.