Understanding Implied Volatility and Strike Price Relationship

Introduction

When trading options, implied volatility (IV) and strike price work together to shape your potential profit, premium cost, and risk exposure. Misunderstanding this relationship can lead to overpriced trades or missed opportunities. In this guide, we’ll explain how implied volatility impacts strike price selection—and how to use it to your advantage.

What Is Implied Volatility (IV)?

Implied volatility represents the market’s expectations of how much a stock or asset will move over a specific period. It doesn’t predict direction—only the expected magnitude of movement.

- High IV = Market expects big moves

- Low IV = Market expects limited movement

IV is expressed as a percentage and is built into the option’s premium.

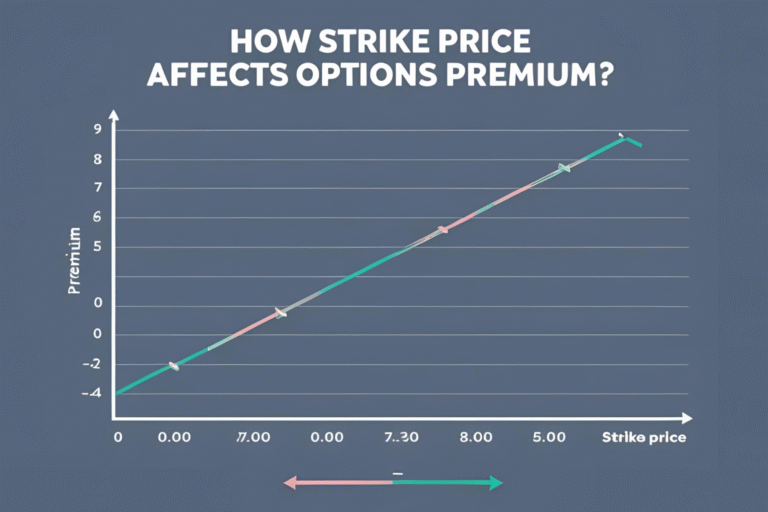

How IV Affects Strike Price Premiums

Implied volatility influences time value, which increases or decreases the premium based on expectations of movement.

- When IV is high, premiums rise—especially for OTM and ATM strikes

- When IV is low, premiums shrink—making all strikes cheaper

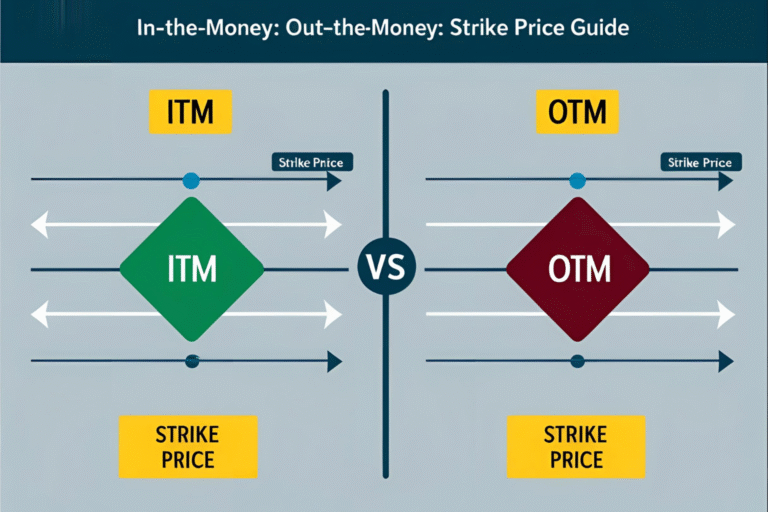

Strike Price Sensitivity to IV

| Strike Type | IV Impact |

|---|---|

| In-the-Money | Less sensitive to IV; more driven by intrinsic value |

| At-the-Money | Highly sensitive to IV changes |

| Out-of-the-Money | Very sensitive; prices fluctuate with IV shifts |

Real Example: SPY Trading at $500

| Strike Price | Option Type | IV Low (15%) Premium | IV High (30%) Premium |

|---|---|---|---|

| $500 (ATM) | Call | $5.00 | $8.50 |

| $510 (OTM) | Call | $2.00 | $4.20 |

| $490 (ITM) | Call | $11.50 | $13.00 |

Note: The OTM option price more than doubles with a volatility spike, while ITM increases modestly.

Using IV to Select Strike Prices

1. High IV Environment

- Consider selling options (e.g., covered calls, credit spreads)

- Choose closer strikes if buying options (to reduce overpaying)

- Avoid deep OTM options—they’re overpriced

2. Low IV Environment

- Consider buying options (they’re cheaper)

- OTM strike prices can offer solid risk-reward

- Anticipate a future IV spike for higher gains

Key Tips for Managing IV Impact

- Always check the IV Rank or IV Percentile to gauge whether current IV is high or low relative to history

- Use multi-leg strategies like vertical spreads to reduce IV exposure

- Avoid buying options during earnings or major events unless you expect a big move

Conclusion

Implied volatility can drastically change how strike prices are valued and which ones are worth trading. Use IV to adjust your strike price selection—choosing safer strikes in high-IV environments and more aggressive ones when IV is low. Mastering this relationship will give you a major edge in options trading.

FAQs

Q1. Does IV change the strike price itself?

No. Strike prices are fixed. IV only affects the premium for each strike.

Q2. Which strike price is most affected by IV?

At-the-money (ATM) options are usually most sensitive to IV changes.

Q3. How do I know if IV is high?

Use IV Rank or IV Percentile—found on most trading platforms.

Q4. Should I avoid trading when IV is high?

Not necessarily. High IV can benefit option sellers but can hurt buyers paying inflated premiums.

Q5. What’s the best strike price strategy in low IV?

Buy slightly OTM or ATM options with time on your side to benefit from potential IV expansion.